Bank of Japan H1 2025

July 10, 2025

The BOJ owns approximately half of all outstanding JGBs and is the dominant buyer of government debt, giving her a crucial role in supporting JGB prices and ensuring pension funds, banks, insurance companies, and other institutions stay solvent.

The blatant and simultaneous issuance and purchase of debt of the government with freshly created bank reserves makes clear the amount of blind faith and belief people have in the current financial system. The way Japanese citizens and foreigners react to the most extreme central bank interventionism and yield curve control (YCC) will inform how other central banks adopt (or reject) similar policies.

A short review of Bank of Japan (BOJ) policy and Japanese Government Bond (JGB) buying through the first half of 2025, prefaced by an overview of the Japanese currency and bond markets. Japan is notable due to the independent path its central bank, which pioneered zero interest rate policy (ZIRP), negative interest rate policy (NIRP), and has swam counter to the current during and after the pandemic, pausing interest rates while other major countries raised them, and raising while others paused and started to cut.

Outline

- Currency

- Yield Curve

- Bank of Japan Monetary Policy

- JGB Purchase Patterns

- Looking Six Months Ahead

Currency

Japan’s largest trading partners are the US and China, so relative strength to these currencies is most impactful on Japanese society and business. As a resource poor island, Japan imports lots of raw materials and energy, while exporting finished goods and electronics.

Currency strength relative to the US Dollar and Chinese Yuan (CNY) is extremely important when it comes to the prices of these everyday goods and competitiveness in the global export market. Currency gets too strong and imports become cheaper but exports are less competitive, or in the current case, when the currency gets too weak imports become expensive and exports become more competitive. Japan usually tries to keep a balanced currency, avoiding the disruption large swings cause, yet the pandemic policies of the BOJ made this impossible.

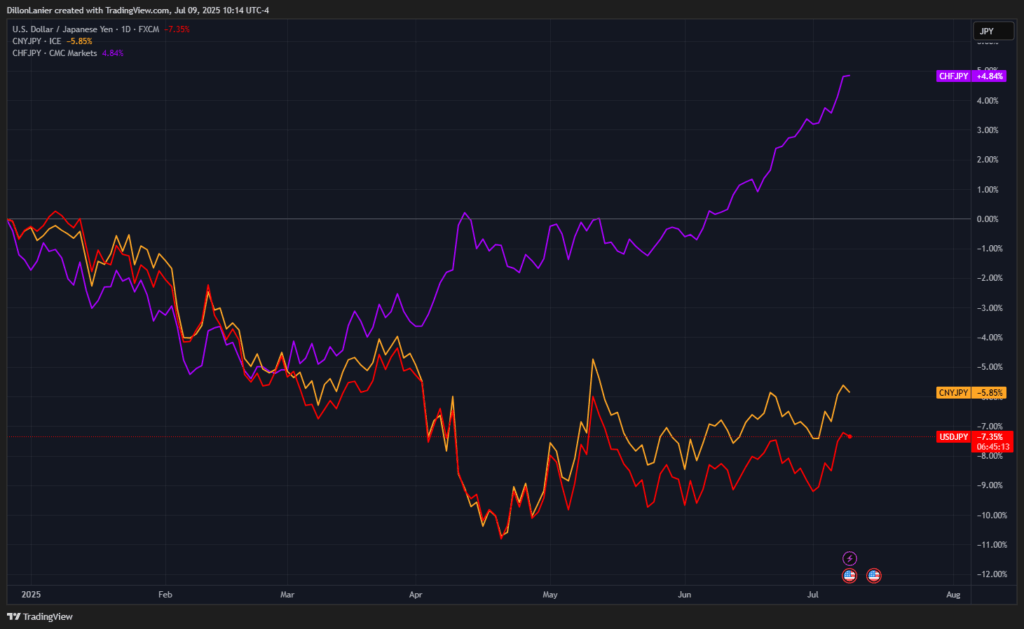

It is hard to overstate the impact COVID era monetary policy had on the Yen, as the differing policies by the BOJ and rest of world (ROW) led to a sharp decline in the Yen (Chart 1).

Thus far in 2025, however we have seen relative Yen strength. This is clearly visible in Chart 1. Thanks to the counter-current monetary policy by the BOJ, which has raised rates while the ROW is cutting or keeping them steady, we are seeing a modest recovery in the Yen.

The clear exception is the Swiss Frank (CHF). Both the Yen and Frank are seen as safe haven currencies, so the divergence between the two is notable. As we zoom in on the chart to focus on the past six months (Chart 2), it is obvious that the breakdown in correlation between the three Yen currency pairs began in April and persists.

As Switzerland is not an important trading partner for Japan, the continued weakness is really only felt by market participants engaged in the more removed aspects of trading. Much more important is the normalization, or at least break in trend, of the Yuan and Dollar. A weak Yen has major negative social implications for Japan, 2025 has brought a respite from foreign currency pressures thus far. If the BOJ continues with tight monetary policy Yen strength seems likely to continue for the remainder of the year.

Yield Curve

The relationship between a developed countries currency and bond markets is generally accepted as cut and clear: when yields go up, the currency strengthens, and when the yields go down, the currency weakens. When this doesn’t happen, people start to freak out, which results in bombastically delivered calls for immanent collapse of faith in government and then society.

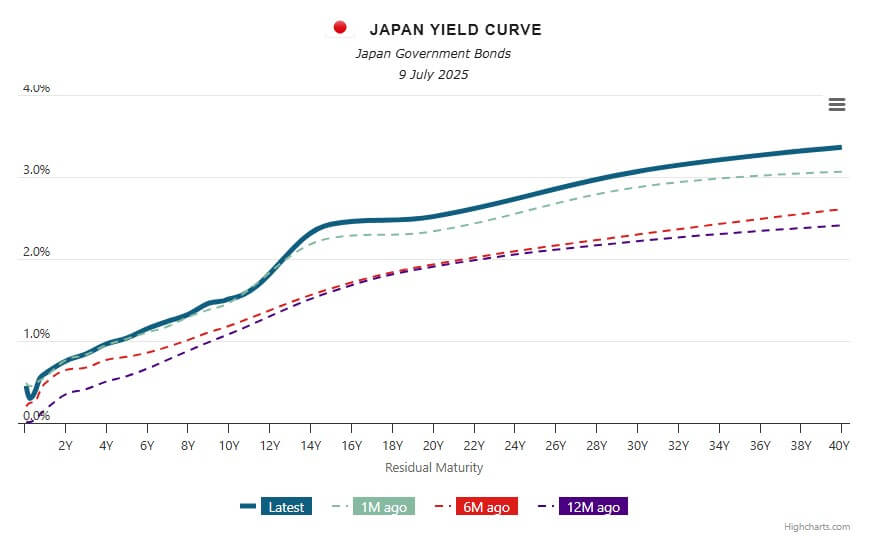

While Japan has seen the correlation breakdown before, miraculously, the country is still humming along. In 2025 the yield curve has steepened and rose across the board. Twenty, Thirty, and Forty year JGBs are reaching yields not seen since the 20th century, but more interestingly short term yields are reaching levels that could lead to much higher interest expense for the Japanese government, which already spends nearly half its budget paying interest on debt.

As evidenced by Chart 3, JGB yields have gone up across the board throughout 2025. This aligns with the simplistic idea that if yields go up, the currency should strengthen as it has vs the USD and Yuan. The steepening of the yield can be seen by looking at each end of the curve – the left side has seen less of an increase in yields over the past 1, 6, and 12 months than the right side has.

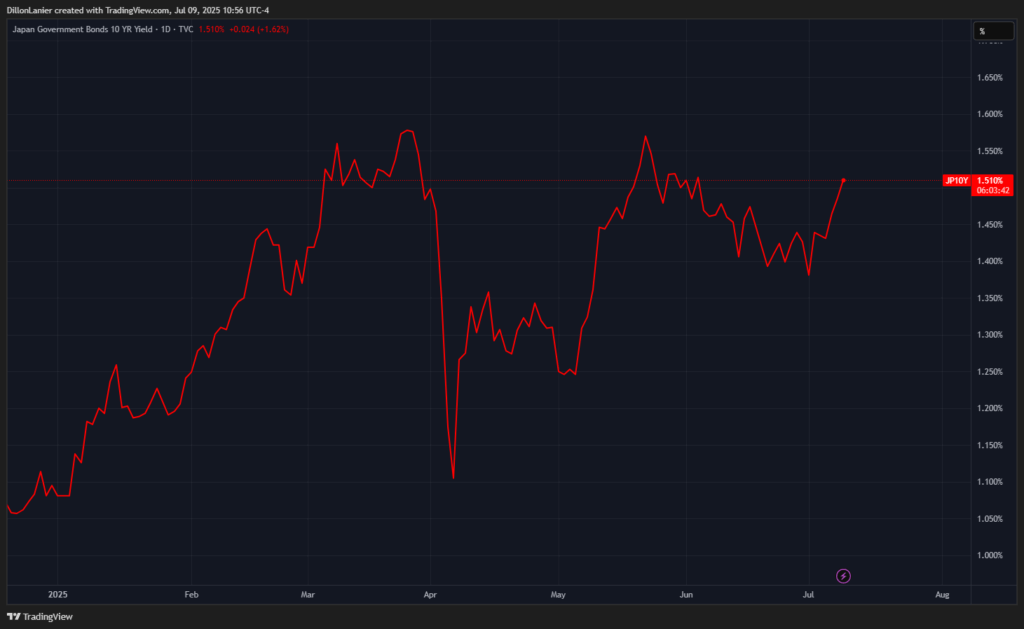

The yield curve gives us a good big picture view of where JGBs are at, but they obscure notable yield variations that occur between time periods, as seen in Chart 4, which shows the 10-year JGB yield over the course of 2025.

The precipitous drop in April is extra notable when considering that is also the point at which CHF/JPY diverged from the the USD and CNY currency pairs.

Bank of Japan Monetary Policy

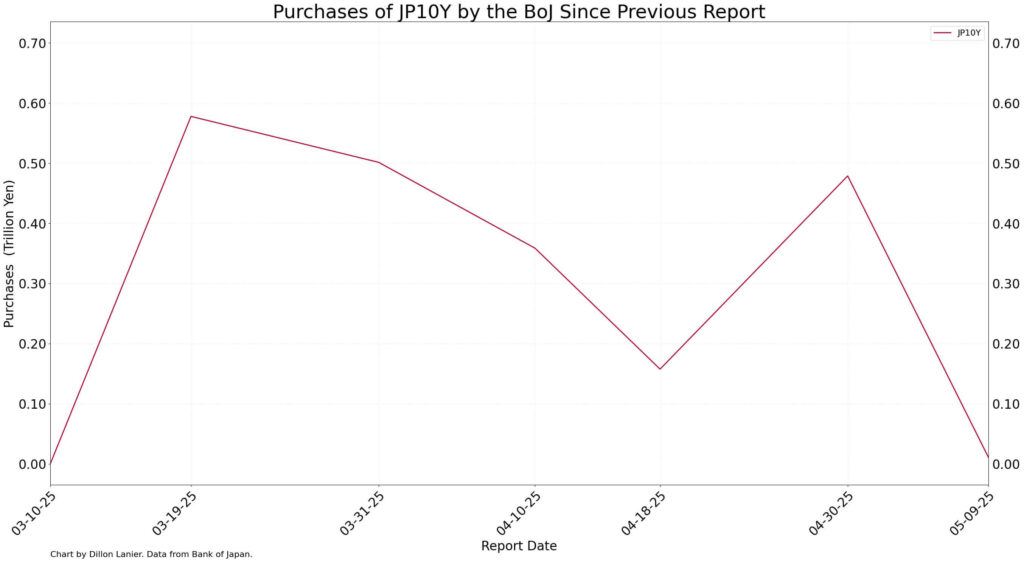

Those familiar with the BOJ’s meddling most likely think ‘open market operation’ whenever there is a rapid decline in 10-year JGB yields, and for good reason. The April decline was different, however, as evidenced by the paltry JGB purchases reported by the BOJ (Chart 5).

Chart 5 makes it clear that the massive 10-year JGB buying at the end of March and beginning of April had nothing to do with the BOJ, for once. More likely it was a flight to safety or repatriation of capital by investors reacting to Trump tariff talks, which peaked during the April 2nd ‘Liberation Day’ unveiling of massive tariffs.

Really the only notable move by the BOJ during 2025 has been raising the short term rate to 0.5% back in January. The short term rate // overnight call rate is the Japanese equivalent of the US Federal Funds rate, setting the rate at which money is lent overnight. Chart 6 shows the history of Japan’s benchmark rate, which is rising for the first time in decades.

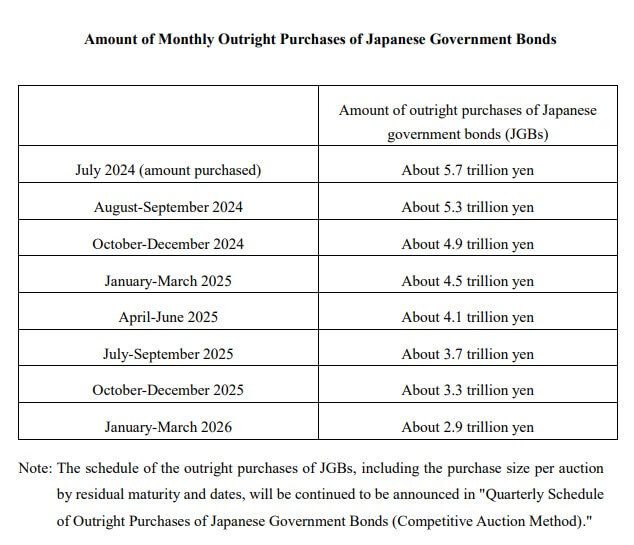

The relative tranquility of the JGB market has meant limited BOJ action. The other key piece of policy that has been worth watching is the planned tapering of JGB purchases (Table 1), which was announced in July of 2024 and has thus far gone according to plan.

Central bank tapering operations last as long as policy makers are comfortable with the interest rates on the bonds they are tapering their purchase of. As soon as rates becoming uncomfortable, the tapering stops. Usually this is well before the planned stop date or bond holding level.

We are more than half way through the scheduled purchase tapering, and while yields have risen, they are not out of control. It seems like the BOJ has a solid chance of making it to March 2026 unscathed!

Purchase Patterns

Notable throughout the first half of 2025 has been the attention paid to the longer end of the JGB yield curve. As mentioned earlier, this portion of the yield curve has gone up faster than the short end, leading to a steepening curve. Chart 7 shows the total purchases made by the BOJ thus far in 2025, broken down by duration.

The green and yellow lines are the notable ones, but we need a little context. Chart 8 shows the same data for the full year of 2024. Half way through 2025 a quick eye test reveals that the BOJ is not on pace to hit the same number for FY2025 as they did in 2024.

What makes this interesting is how different yields are now than they were in 2024. The 20 and 30 year JGB yields are up ~25-30% YOY as of writing. That is a massive move in the world of sovereign bonds. Despite the climb in yields, the BOJ is still tapering purchases is on pace to buy less JGBs in 2025 than they did in 2024, even though yields are in a strong uptrend.

Current BOJ Governor Ueda took power in April 2023 and has taken a vastly different approach to the central bank’s JGB policies. There have been no vast, indiscriminate, panicky feeling ‘open market’ operations to control the 10-year. Ueda ended NIRP, raised rates multiple times, and is clearly doing his best to reduce the role of the BOJ in the JGB market.

Arguably it is a Sisyphean task. It is hard to imagine the JGB market running functionally without the BOJ unless immense social hardship is suffered. Yields would rocket, putting huge holes in the balance sheets of insurance companies, pension funds, and banks, which would either collapse, be bought at steep discounts, or be bailed out (starting the cycle again).

If removing the BOJ from its essential role of stabilizing JGB prices is possible (or even the end goal), it will take a long time to do so in an orderly way. The current purchase patterns are a step in the right direction. A year of following their JGB purchase reduction plan, no open market operations, and declining (if marginally) balance sheet is a good start.

Looking Six Months Ahead

For me the big question is, can the calm continue? Will the BOJ be able to stick to the purchase schedule and keep yields in a comfortable place? We don’t know what the level or pace of change in yields for an intervention is, and without that one can only guess and read between the lines.

A simultaneous break above the late March peak in yields across all JGBs would most likely be cause for concern. I think it is extremely likely this happens in 2025 unless the Yen falls off a cliff (remember the basic correlation – yields up, currency up and vice-versa), or there is some sort of global slow down or catastrophe that sends investors running for shelter. However, I don’t think the BOJ will push the emergency button when JGB yields break out to new decade highs. Only time will tell.

Leave a Reply

You must be logged in to post a comment.