Why Doesn’t the BOJ Buy More Long Dated Bonds?

September 22, 2025

The most important job of the BOJ is to buy Japanese government bonds (JGBs) and stash them away, thus limiting supply in the market. This activity serves the dual purpose of keeping the government funded and keeping interest rates lower, so a minimal amount of the federal budget (~24.4%) can be used to service existing debt.

Keeping interest rates manageable on bonds with longer terms is especially important, as the government is locked into whatever rate they issue at for decades. Due to a confluence of numerous factors long dated JGB rates are making multi decade highs– This article will explore why the BOJ doesn’t buy more of these bonds to keep rates in check.

Outline

- JGB Market Summary

- Current guidance and constraints

- Current issuance volume

- The big ‘IF’

- Resolution

JGB Market Summary

Demand for JGBs currently comes from banks, insurance companies, foreigners, pension funds, and of course, the BOJ (Figure 1). The flow of JGBs on and off the balance sheet of these entities dictates bond prices and interest rates.

Given the BOJ purchase tapering currently underway and the rise of sovereign interest rates world wide, it should come as no surprise that JGB yields are rising across the board (Figure 2).

As long end bond (10+ years) interest rates continually make 21st century highs, it is inevitable that the federal budget has to dedicate more and more money to servicing the debt. Actions by the BOJ are likely to becoming driven by fiscal necessity instead of intentional monetary policy. The idealistically independent central bank becomes a functional arm of the government when the countries fiscal needs drive policy.

Current Guidance and Constraints

Other key aspects of the current BOJ market are the stated guidance on the overnight call rate and 10-year JGB. In January of 2025 the call rate cap was moved to 0.5%, and in October of 2023 the 10-year JGB cap was officially removed, with ‘nimble operations conducted’ above and below 1%. The 10-year JGB rate is 1.59% at time of writing on Sept. 9, 2025.

The BOJ issued monthly purchase operations guidance in July of 2024 that outlines purchase targets through Q1 of 2026. Current guidance dictates 3.7 trillion yen worth of JGB purchases each month, which is less than the current maturation rate, meaning the BOJ is reducing its total holdings of JGBs, if slowly.

This purchase tapering limits the impact the BOJ can have on interest rates, unless they pull the panic switch and go into the market with a blank check, like they did multiple times at the end of 2022 and into early 2023. Table 1 shows the 10 largest net changes in BOJ JGB holdings since 2015. Reminder that the BOJ currently buys ~1.23 trillion yen worth of JGBs during a ~10 day reporting period.

Current guidance no longer puts a firm and public cap on the 10-year, so the BOJ is not forced to defend a specific level, giving them more flexibility and keeping the market on its toes. However, the guidance does limit and reduce over time the amount of monthly purchases the BOJ can make, which has contributed to a steady climb in yields to what many believe are near or at unspoken caps.

Workarounds to the current guidance and constraints are the overnight repo market and open market operations. The first allows for the BOJ to supply funds in exchange for cash on a day-by-day basis, usually at face value (as opposed to market value). This trade can be done perpetually for a small fee (the overnight call rate), allowing participants to avoid selling assets at a loss by providing a way for them to end each day with more cash thanks to the repo transaction. The second method, open market operations is more blunt, and simply means the BOJ buys up as many JGBs as it likes until rates are at the desired level.

Current Issuance Volume

Each year the Ministry of Finance (MOF) and Diet decide how many JGBs will be issued to finance the federal budget. The number is generally decided by the simple calculation of budget expenses – revenue = JGB issuance. In other words, JGBs finance the part of the budget taxes and other government income doesn’t cover.

Japan has a reasonable fiscal deficit, meaning inline with other developed countries, as Figure 3 shows. However their debt to GDP levels blows every other developed country out of the water (Figure 4).

Japanese bond issuance relative to economic production is really high. Figure 5 shows historical issuance and a downtrend in total JGB issuance since 2020.

Long End Bonds

Thus far a lot of charts and words have been bandied around without getting to the heart of this piece’s purpose: why doesn’t the BOJ buy more long dated JGBs?

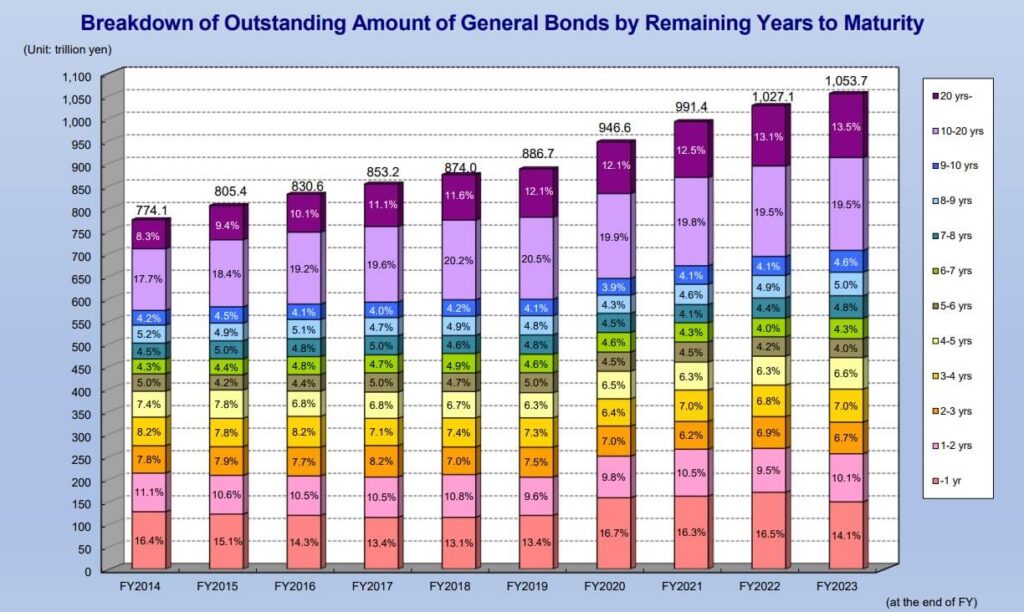

These bonds make up around 1/3 of Japans outstanding JGBs (Figure 6), and have higher interest rates than shorter dated bonds. While on one hand long dated debt matures less frequently, on the other it can require refinancing at vastly different rates since so much time passes between issuance and maturity.

Not only does issuing long dated JGBs at higher interest rates lock in an expensive long term obligation, it also sets the expectation for future inflation and rising prices. Keeping long term rates in check by buying long duration JGBs is a logical method to control debt service expense and inflation expectations.

The latest three month outright purchase plan released by the BOJ has them spending 14.8% of their budget on long dated (20, 30, 40 year) bonds. While at first thought this number sounds low when compared to 33% of their book being bonds with these original terms, upon further inspection it is actually a pretty high number.

Since the long dated bonds take forever to roll off, over time they will build up on the balance sheet even if the monthly purchases are only a fraction of the short dated bonds. The reality is that the BOJ is buying plenty of long dated bonds and long dated bonds pose a difficult problem.

Buy too many, like the BOJ did a few decades ago, and you end up where we are today: massive JGB holding and tons of long dated bonds on the book. Additionally, there is more time for price discovery on these bonds – repurchases and resales have a larger effect on the interest rates than they do with shorter term bonds.

The BOJ isn’t buying more long term debt because they really do want to own fewer JGBs, and they’re already buying proportionally more of it than short term stuff.

Without a doubt longer term interest rates are more difficult to control than short term ones. Take every major country setting an overnight interest rate that is strictly adhered to vs none of them setting long term interest rates. The BOJ is in a tough spot. One where central bank speeches, policy announcement, and oversight can only do so much when colliding with a reorganization of global trade, higher price inflation, and an aging population.

Leave a Reply

You must be logged in to post a comment.